Webinars in Collaboration with IFC

SBP Refinance Facilitates to Combat Covid-19

Refinance Scheme for Payment of Wages and Salaries

Temporary Economic Refinance Facility

Relief under SME Financing & SBP Refinance Schemes to Dampen the Effects of Covid-19

Upcoming Webinars

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | ||

| 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 13 | 14 | 15 | 16 | 17 | 18 | 19 |

| 20 | 21 | 22 | 23 | 24 | 25 | 26 |

| 27 | 28 | 29 | 30 | 31 | ||

Webinars in Collaboration with IFC

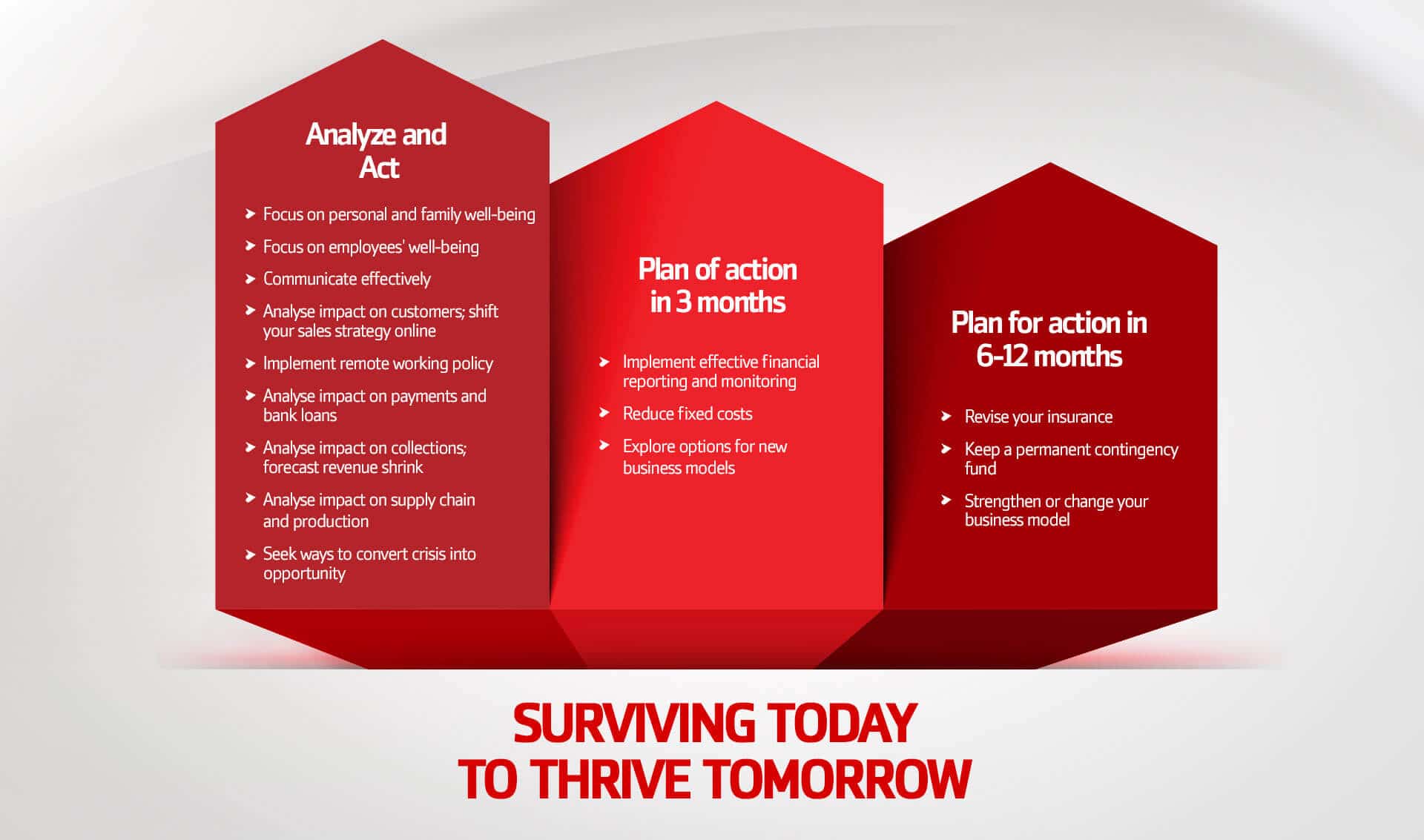

Adjusting your business plan during crisis

Communicating with stakeholders during crisis

SBP Refinance Facilities to Combat Covid-19

In this Hour of Need for Pakistan, Let’s fight Corona Virus together!

Bank Alfalah offers the State Bank of Pakistan’s concessional refinance facility to all the hospitals and medical centers of the country that are fighting at the forefront of this national crisis.

In view of health emergency in the country and to facilitate hospitals in entertaining patients even other than those of COVID-19, SBP has extended the scope of refinance scheme to cover setting up or expansion of the existing hospitals and medical centers subject to the following minimum conditions:

- Registration with respective Provincial/Federal agencies/commissions

- 50 Bedded tertiary care hospital

- 24 hours fully equipped emergency

- In house Laboratory facility including Radiology/ CT/ MRI/ Ultrasound/ angiography/ angioplasty

- ICU/CCU with ventilators attached to each bed

- Operation theaters and OPD facility

Features

- Maximum Financing Limit: PKR 500 million

- Purpose: i) Purchase of new imported and local equipment

ii) Construction of isolation wards (up to 100% of civil works) - Tenor: 5 years

- Markup rate: Maximum 3% per annum

- Validity of this facility: 30th June, 2021

For Quick Access, Contact Us:

Email: sme.helpdesk@bankalfalah.com / smesupport.covid19@bankalfalah.com

Call: +92 300 432 4007/ 111 225 111

Bank Alfalah offers the State Bank of Pakistan’s Temporary Economic Refinance Facility (TERF) to support sustainable economic growth especially in the backdrop of challenges being faced by the industry in post-pandemic scenario. Businesses can avail long term finance facility for purchase of new imported and locally manufactured plant & machinery for setting of new projects.

- Maximum Financing Limit: PKR 5 billion per project

- Tenor: Financing is available for a maximum of 10 years including grace period of up to 2 years

- Markup rate: Maximum 5% per annum

- Markup Repayment: Quarterly/Half-yearly basis

- Validity of this facility: 31st March, 2021

Letter of Credits/ Inland letter of credits established prior to issuance of the schemes but retired/ to be retired after March 17, 2020 will also be eligible for this refinance.

For Quick Access, Contact Us:

Email: sme.helpdesk@bankalfalah.com / smesupport.covid19@bankalfalah.com

Call: +92 300 432 4007/ 111 225 111

Offer available to:

- Existing payroll clients who also maintain a lending relationship with Bank Alfalah

- Existing payroll clients who do not maintain a lending relationship with Bank Alfalah

- Clients who maintain a lending relationship but are not availing payroll services with Bank Alfalah

- Existing and potential clients who do not maintain either payroll or lending relationship with Bank Alfalah

Features of Refinance Facility:

| Category | Wage Bill for 3 months | Loan Limit | Maximum Loan Limit |

|---|---|---|---|

| A | Less than or equal to Rs. 500 million | 100% of actual 3 months wage bill | Rs. 500 M |

| B | More than Rs. 500 million | Rs. 500 million or 75% of 3 months wage bill, whichever is higher |

Rs. 1000 M |

- End-user markup rate: Up to 5%

- Loan repayment: Starts from January 2021 after disbursement period of three months followed by maximum grace period of six months

- Repayment of loan: Principal amount will be made in 8 equal quarterly installments

- Validity of this facility: June 30, 2020

Bank Alfalah offers relief under SME financing through deferring repayment of principal loan amount by one year upon a written request of an obligor received before 30th June 2020, provided that the obligor will continue to service the mark-up amount as per agreed terms & conditions.

The financing facilities of such obligors, which are unable to service the mark-up amount or need deferment exceeding one year, may be rescheduled / restructured upon their request.

In order to broaden the scope of our earlier relaxations, Bank Alfalah offers deferment of only principal amount for one year or rescheduling/restructuring of the loans relaxation for following SBP refinance schemes along with their respective Shariah compliant alternative schemes:

- Long Term Financing Facility (LTFF)

- Financing Facility for Storage of Agricultural Produce (FFSAP)

- Refinance Facility for Modernization of SMEs

- Refinance and Credit Guarantee Scheme for Women Entrepreneurs

- Refinance Scheme for Working Capital Financing of SE and Low-End ME

- Small Enterprise (SE) Financing and Credit Guarantee Scheme for Special Persons

Validity of the facility: 30th June,2020

For Quick Access, Contact Us:

Email: sme.helpdesk@bankalfalah.com / smesupport.covid19@bankalfalah.com

Call: +92 300 432 4007/ 111 225 111

Bank Alfalah offers the State Bank of Pakistan’s Temporary Economic Refinance Facility (TERF) to support sustainable economic growth especially in the backdrop of challenges being faced by the industry in post-pandemic scenario. Businesses can avail long term finance facility for purchase of new imported and locally manufactured plant & machinery for setting of new projects.

- Maximum Financing Limit: PKR 5 billion per project

- Tenor: Financing is available for a maximum of 10 years including grace period of up to 2 years

- Markup rate: Maximum 5% per annum

- Markup Repayment: Quarterly/Half-yearly basis

- Validity of this facility: 31st March, 2021

Letter of Credits/ Inland letter of credits established prior to issuance of the schemes but retired/ to be retired after March 17, 2020 will also be eligible for this refinance.

For Quick Access, Contact Us:

Email: sme.helpdesk@bankalfalah.com / smesupport.covid19@bankalfalah.com

Call: +92 300 432 4007/ 111 225 111